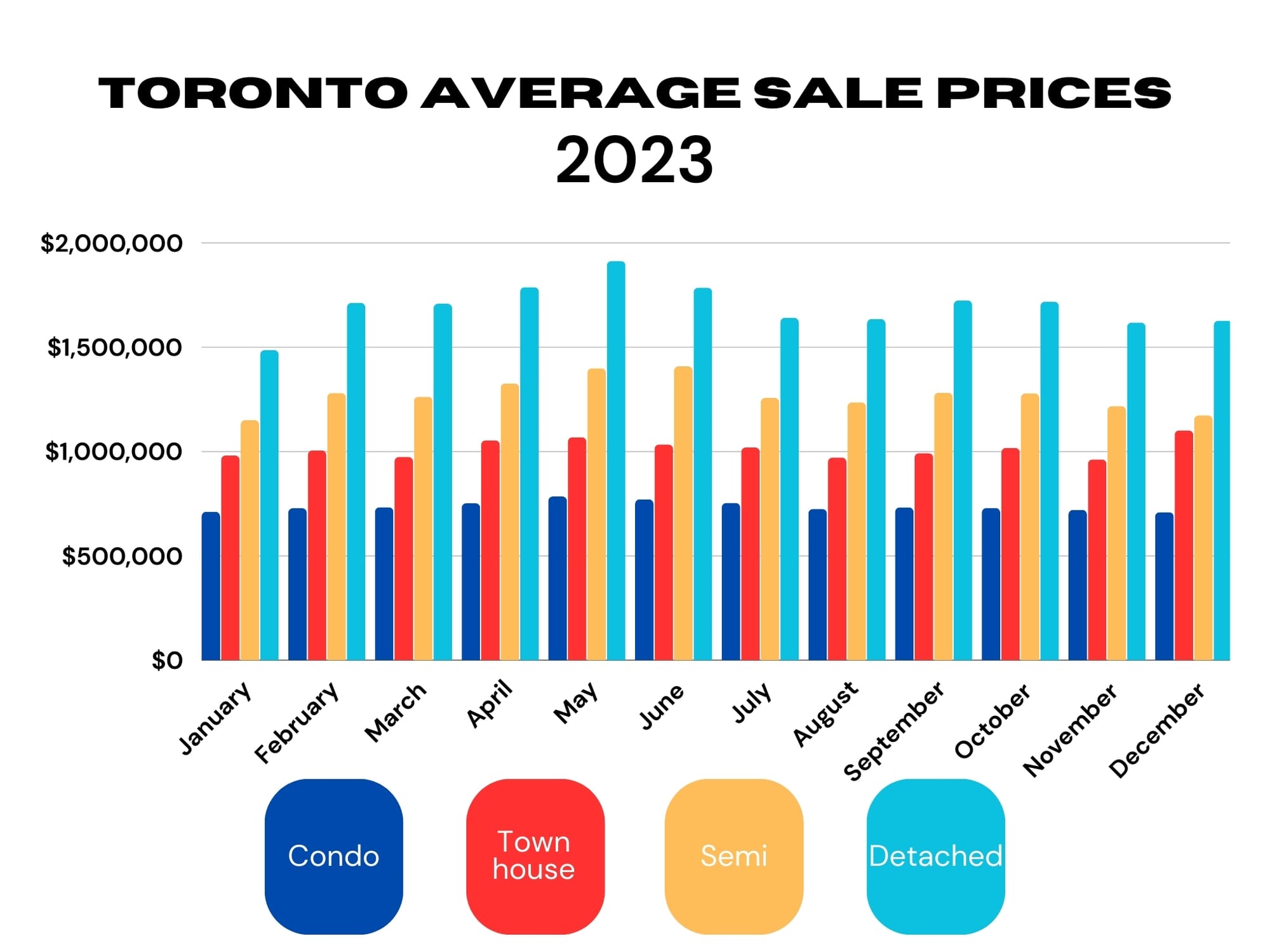

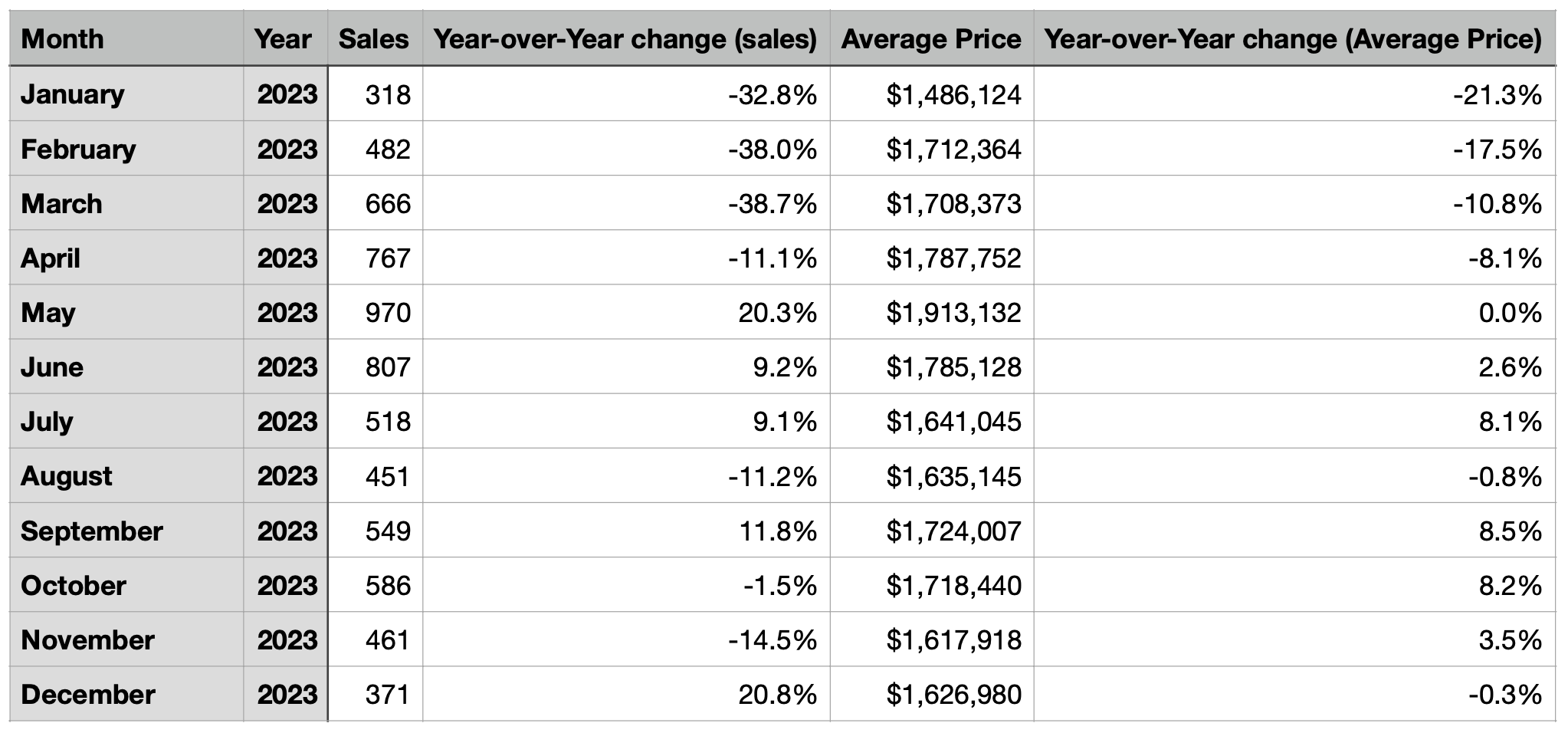

2023 will be remembered as one of the slowest & hardest years for the Toronto real estate market in recent history (besides the beginning of COVID) with a substantial reduction in sales numbers and general softening of prices.

Increased borrowing costs as a result of the Bank of Canada keeping interest rates higher was the main cause of this drastic shift in the market as many potential buyers pulled back due to a lack of affordability & likewise many sellers sidelined their ambitions in hopes of better conditions in 2024.

While sales numbers & average sales prices were severely hit in the earlier months of 2023, we did see a slow rebound in the later months of the year as buyers & sellers adjusted to the reality of the market.

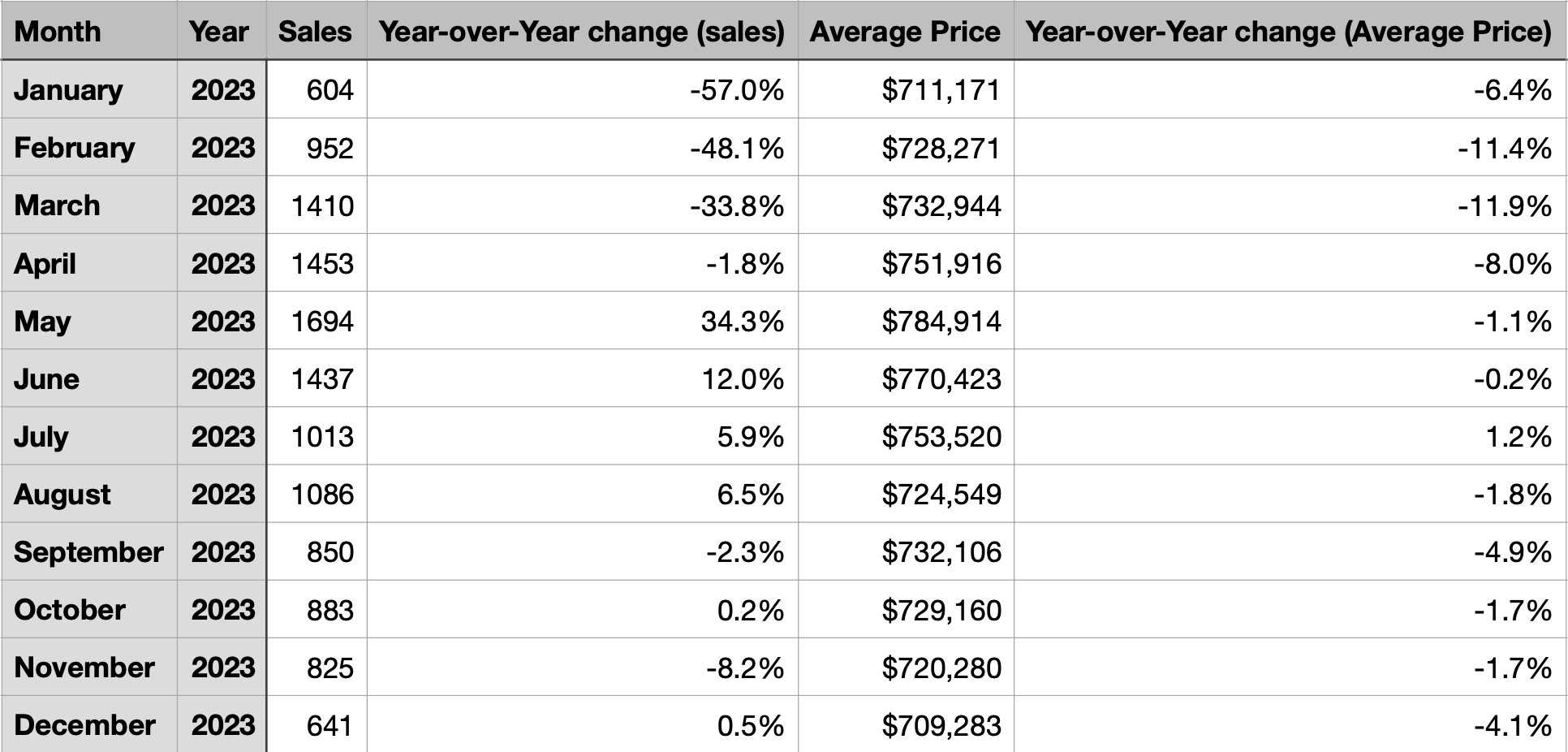

Condos

The average sale price of condos has lowered from the heights of early 2022 where we saw prices in the $800k+ range but overall things have stayed fairly steady in the low $700,000's.

This trend will likely continue in 2024 with numerous new construction condos taking occupancy this year that will bring added inventory to an already somewhat saturated market (particularly for the Studio & 1-Bed units).

2 & 3-Bed units with bigger floor plans have faired the best throughout this period with relatively low inventory levels & higher demand.

This largely came as a result of more couples/families/investors having to choose this option as townhouses/semi-detached homes remained out of affordability given higher interest rates.

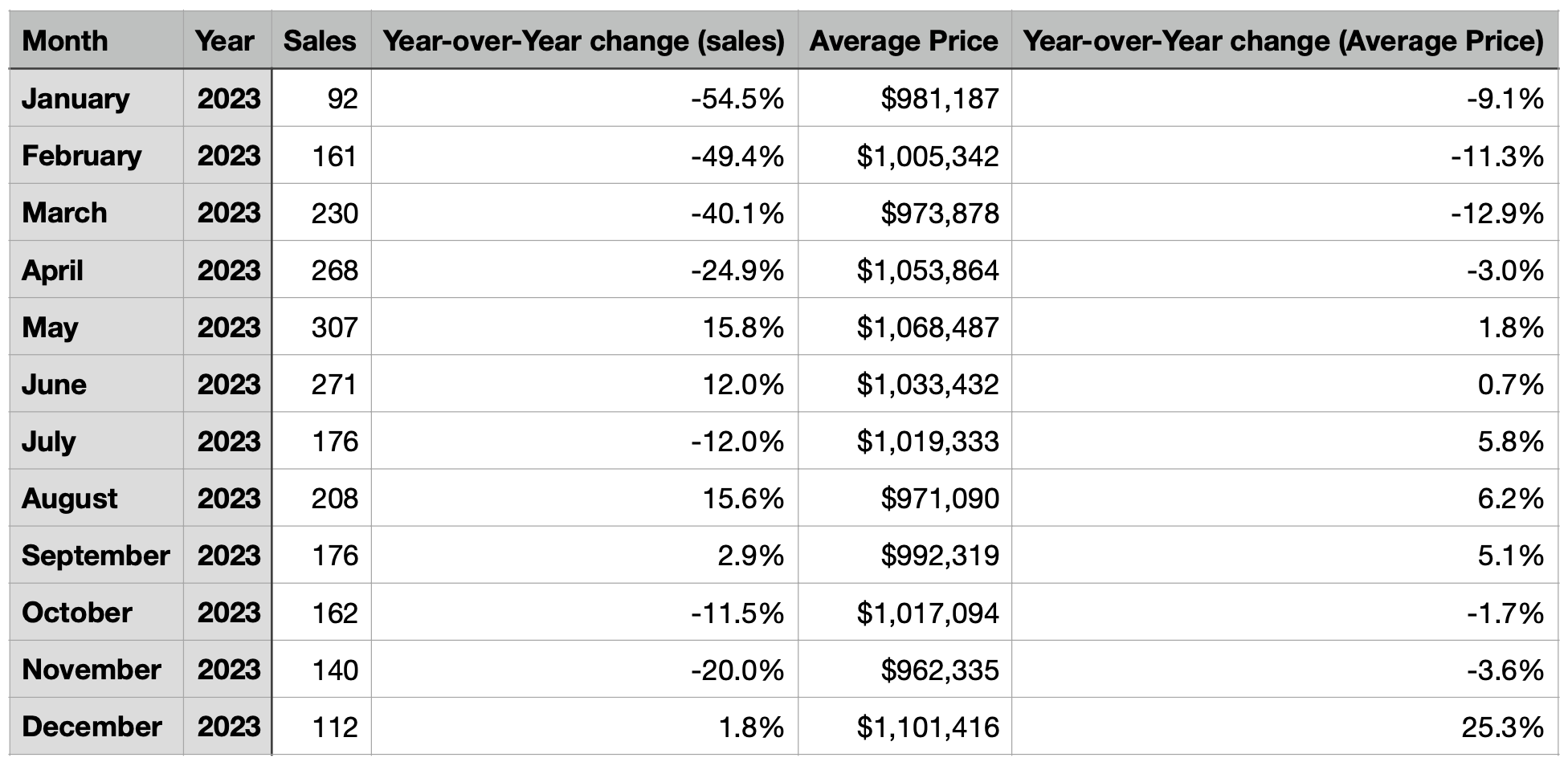

Townhouses

Townhouses in Toronto continued to be the go-to option for many buyers who were priced out of the semi/detached housing market but wanted more space than a condo.

While sales numbers were substantially lower at the beginning of the year, things to started to even out more in Q4 with the average price in December 2023 reaching similar levels to those seen in February/March 2022 when the market was extremely competitive.

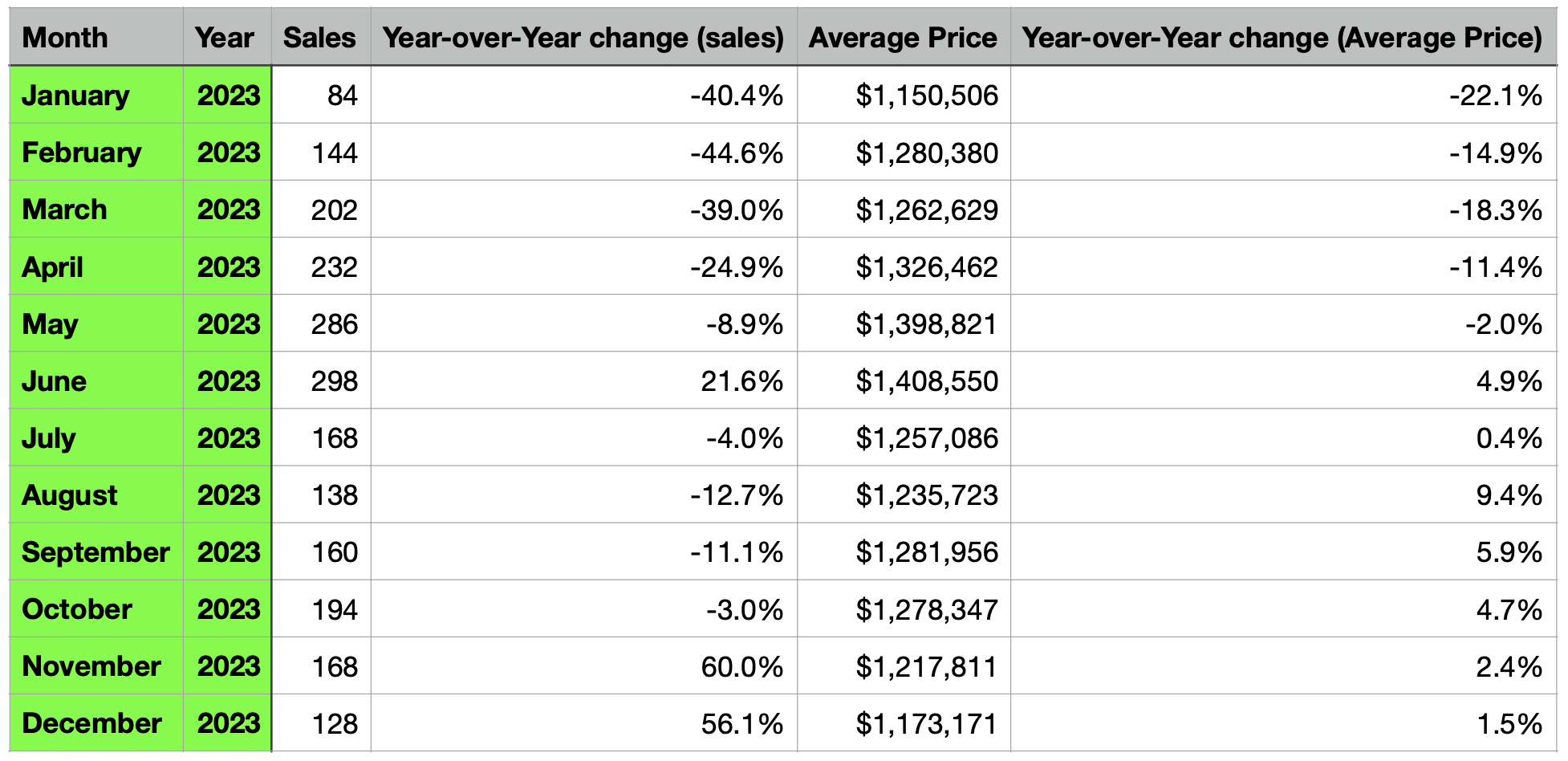

Semi-Detached Homes

The cooling trend of prices for semi-detached homes in Toronto which started at the end of 2022 continued on throughout much of this year with average prices lowering to levels not seen since early 2021.

Despite this lowering of sale prices, the increased cost of borrowing was a major detractor for many potential home buyers who either decided to sideline their search or choose an alternative option that they could afford at current rates.

This will likely continue this year until rates start coming down & buyers/sellers feel more confident of their position in the market.

Detached Homes

Detached homes in Toronto had seen some of the most persistent reduction in year-over-year sales throughout 2022 but this trend seemed to switch in 2023 with numbers actually increasing by the end of the year.

While the average sale price has dropped substantially from its $2M mark in February 2022, prices in many neighbourhoods have stayed fairly level due to the fact their is limited inventory in many desirable neighbourhoods like Riverdale, Leslieville, Roncesvalles, etc.

2024 will likely see more of the same conditions but certain areas could start to see a surge of sales in the spring as buyers pre-empt the Bank of Canada's announcements in April/June.

Summary

Is the hardest year of Toronto real estate behind us? Likely, yes.

Unless interest rates stay high (which seems unlikely based on the predictions of many industry experts), we will see a flurry of activity in the first parts of the spring market with potentially a large surge in June if the B0C lowers rates as many buyers/sellers come off the sideline & rush back to the market.

Be sure to check back every month for our latest market analysis!

Rylie C.

Sources

Comments