The Greater Toronto Area (GTA) real estate market experienced a significant shift in February 2023, as sales and new listings both dropped considerably year-over-year.

This comes as a result of the Bank of Canada's interest rate hikes that began in early 2022.

In this detailed analysis of the Toronto real estate market stats for February, we'll explore the factors that have led to these trends, the average sale prices for different home types, and the potential implications for the future of the GTA housing market.

Impact of Interest Rate Hikes on Sales and Prices

In February 2023, GTA REALTORS® reported 4,783 sales through TRREB's MLS® System, a 47% decrease compared to February 2022, the last full month before the onset of interest rate hikes.

The number of new listings also declined, down by a similar annual rate of 40.9% to 8,367.

The Bank of Canada's rate hikes have had a notable impact on home prices, which dropped from the record peak in February 2022.

This mitigated the effect of higher borrowing costs, leading many homebuyers to opt for lower-priced homes to offset these costs.

TRREB President Paul Baron explained that the share of home purchases below one million dollars is up substantially compared to this time last year. This indicates that homebuyers are making more conservative purchasing decisions in light of the higher borrowing costs associated with increased interest rates.

Price Changes and Market Segments

The average selling price for February 2023 was $1,095,617, down 17.9% compared to February 2022.

This decline can be partially attributed to the increase in sales of homes priced below $1,000,000, which made up 57% of sales in February 2023 compared to 38% a year earlier.

The MLS® Home Price Index (HPI) Composite Benchmark followed a similar pattern, down year-over-year by 17.7%, but up on a monthly basis.

Market analyst Jason Mercer suggests that increased demand driven by improved buying intentions for 2023 will be met with a constrained supply of listings, leading to increased competition among buyers.

This could result in renewed price growth in several market segments, particularly those catering to first-time buyers facing increased rental costs.

Housing Supply and Policy Debates

With a June mayoral by-election approaching in Toronto, housing supply will be a central topic in the policy debate. TRREB Chief Executive Officer John DiMichele emphasizes the need for new and innovative solutions, such as the City of Toronto's initiative to allow duplexes, triplexes, and fourplexes in all neighborhoods citywide.

These initiatives are essential for addressing the housing supply challenges that will accompany record population growth in the coming years.

Sales and Average Price by Major Home Type

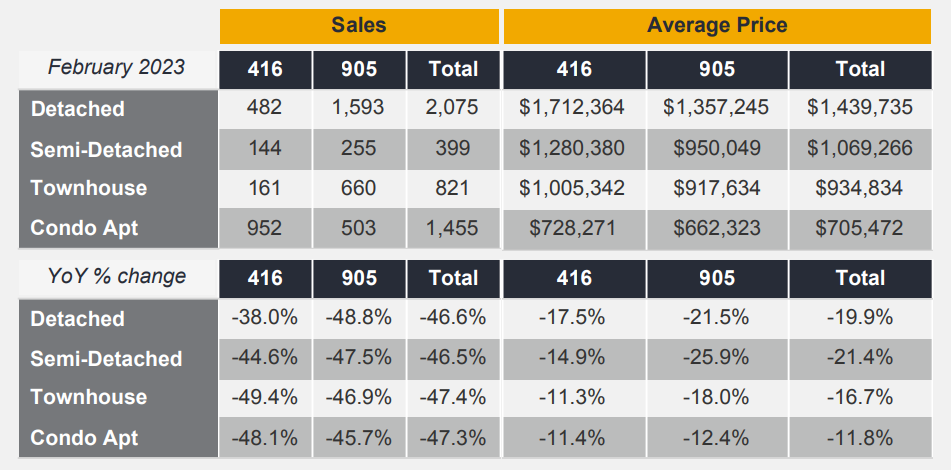

A closer look at the sales and average prices for major home types in both Toronto and the 905 area reveals a consistent trend of declining sales and prices compared to February 2022.

Detached homes, semi-detached homes, townhouses, and condos all experienced a decrease in both sales and average sale price year-over-year.

- Detached homes in Toronto experienced a 38% decrease in sales and a 17.5% decrease in the average sale price, dropping to $1,712,364.

Meanwhile, those in the 905 area saw a 48.8% decrease in sales and a 21.5% decrease in the average sale price, dropping to $1,357,245. - Semi-detached homes in Toronto had a 44.6% decrease in sales and a 14.9% decrease in the average sale price, dropping to $1,280,380.

In the 905 area, semi-detached homes experienced a 47.5% decrease in sales and a 25.9% decrease in the average sale price, dropping to $950,049. - Townhouses in Toronto saw a 49.4% decrease in sales and an 11.3% decrease in the average sale price, dropping to $1,005,342.

Meanwhile, those in the 905 area had a 46.9% decrease in sales and an 18% decrease in the average sale price, dropping to $917,634. - Condos in Toronto experienced a 48.1% decrease in sales and an 11.4% decrease in the average sale price, dropping to $728,271.

In the 905 area, condos saw a 45.7% decrease in sales and a 12.4% decrease in the average sale price, dropping to $662,323.

Several economic indicators provide additional context for the changes in the Toronto real estate market:

- Real GDP Growth - Q4 2022 = 0%: This stagnation indicates that the overall economy was not growing during the last quarter of 2022, which could contribute to the declining housing market trends.

- Toronto Employment Growth - January 2023 = +0.3%: Although employment growth is positive, the modest increase suggests that job growth is not robust enough to significantly boost housing demand.

- Toronto Unemployment Rate - January 2023 = 6%: This rate is relatively stable, but it still indicates that there is some level of unemployment affecting the population's ability to purchase homes.

- Inflation (Yr./Yr. CPI Growth) - January 2023 = 5.9%: The high inflation rate means that the cost of living is increasing, which could be affecting the affordability of housing and other essential expenses for potential homebuyers.

- Bank of Canada Overnight Rate - January 2023 = 4.5%: This increased rate reflects the central bank's efforts to control inflation and stabilize the economy, but it also contributes to higher borrowing costs for homebuyers.

- Prime Rate - February 2023 = 6.7%: The prime rate affects variable mortgage rates and other consumer borrowing rates, and its increase also contributes to higher borrowing costs for homebuyers.

- Mortgage Rates - February 2023:

1-Year = 6.34%

3-Year = 6.14%

5-Year = 6.49%

These mortgage rates are significantly higher than those of previous years, which could be affecting the affordability of home financing for potential buyers.

The February 2023 Toronto real estate market statistics reveal the ongoing impact of interest rate hikes and other economic factors on the GTA housing market.

As demand continues to rise and supply remains constrained, it's crucial for policymakers and industry stakeholders to work together on innovative solutions to address housing affordability and availability.

This collaboration will be essential for sustaining a healthy and diverse real estate market in the GTA, ensuring that both first-time homebuyers and those looking to upgrade or downsize can find suitable housing options in the face of increasing competition and changing market conditions.

As we continue to navigate the ever-changing landscape of the Toronto real estate market, stay connected with me for the latest insights, trends, and tips.

I'm here to help guide you through your home buying or selling journey. Don't miss out on valuable information – follow me on Instagram or TikTok for up-to-date market news, advice, and life around Toronto!

Rylie C.

Source

https://trreb.ca/files/market-stats/market-watch/mw2302.pdf

Comments